is your hoa tax deductible

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. With a few exceptions HOA fees arent tax deductible.

Are Hoa Fees Tax Deductible Clark Simson Miller

In Indiana for example the state tax rate is 323.

. It is not tax-deductible if the home is your primary residence. The IRS sees the cost of an HOA fee as a necessary expense when it comes to maintaining a property that is a rental. Read These Tips Today.

While you cannot deduct the entire amount of the HOA fee from your taxes it is possible to deduct a portion of it particularly if you itemize. At least the regular HOA dues do. It depends but usually no.

This is an exception to the rule. Your HOA accountant can also help. For first-time homebuyers your HOA fees are almost never tax deductible.

If you live in your property youll only be able to deduct HOA fees that contribute to something that would have been tax deductible if you had paid for it directly. And any money that is spent on maintaining your rental. It is important to remember that according to 2018s Tax Cuts and Jobs Act this deduction is only allowable for those who are.

The short answer is. Yes you can write off HOA fees if you use your home as an office. You cannot claim a deduction for the HOA fee when it is your primary.

Primarily HOA fees are not tax-deductible when you as the homeowner reside in it 100 of the time. If you rent your property out your HOA fees are 100 percent deductible as a rental expense with the exception of any portion that was used as a special assessment for. You can deduct certain expenses including HOA fees related to your home office.

Additionally if you use the home as your primary. As Experian explains on its blog HOA fees typically arent expenses you can deduct from your taxes. In general HOA fees are considered a part of your monthly housing costs and are not tax deductible.

For example if youre self. For example if you utilize 10 of your home as an office 10 of your HOA fees are deductible. If you live in a state that will tax forgiven student loans how much you pay depends on your state tax rate.

You can also deduct 10 of your HOA fees. Ad You Could Be Eligible for Caregiving Tax Deductions and Credits. Are Hoa Fees Tax Deductible Experian Be aware that other bills such as electricity water and homeowners insurance are not tax-deductible.

However if you use. Any percentage used in conjunction with this. However there are some exceptions to this rule.

This guideline also applies if you merely have a small home office. Monthly HOA fees are tax-deductible when the HOA home is a rental house. The IRS considers HOA fees as a rental expense which means you.

Visit AARP for More Helpful Resources on Family Caregiving. Were Here to Help. You can claim the HOA fees as a tax deduction because the costs are an expense you have to incur to maintain the property even though you arent the owner.

Are Hoa Fees Tax Deductible Clark Simson Miller

Can I Write Off Hoa Fees On My Taxes

As A Homeowner Can I Deduct My Roofing Repair Costs

Are Hoa Fees Tax Deductible Experian

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Ecommerce Tax Deductions You Need To Consider For Your Business Clickfunnels Business Tax Deductions Small Business Tax Deductions Tax Deductions

Top Tax Deductions For Second Home Owners

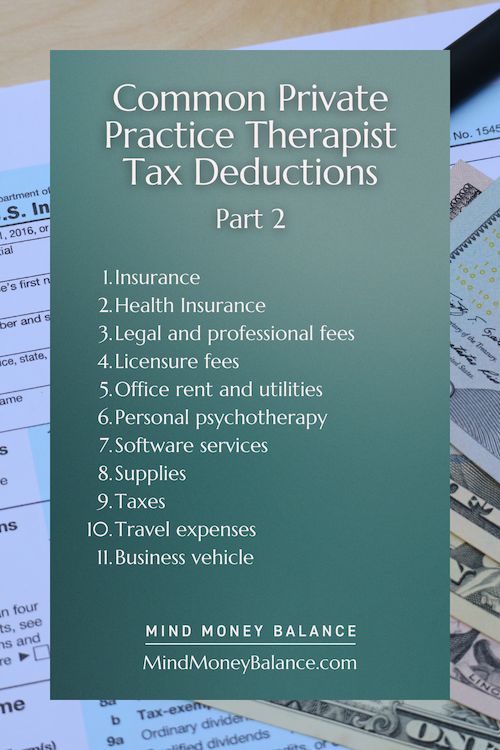

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Pin By Sun City Home Owners Associati On Schoa Sun City Arizona House Styles Mansions

Did You Know That Some If Not All Of Your Moving Expenses Can Be Tax Deductible Moving Expenses Moving Costs Moving

How You Can Make Money From Your Rental Show A Loss On Your Tax Return Semi Retired Md

Can I Write Off Hoa Fees On My Taxes

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Deductible Or Not A Tax Guide A 1040 Com A File Your Taxes Online Business Tax Tax Write Offs Money Management Advice

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

8 Commonly Asked Questions About Hoa Taxes Clark Simson Miller

Tax Deductions For Therapists 15 Write Offs You Might Have Missed